There’s been an interesting back-and-forth occurring on TechCrunch the past couple of weeks about angel investing performance.

The Anti-Camp: Angel investors can’t win

In this corner, we’ve got Wealthfront’s Andy Rachleff. He penned an article entitled Why Angel Investors Don’t Make Money…. In his post, Rachleff explains how professional venture investors do make money (and at that, a small minority).

The winning formula?

Those premier venture firms succeed because they have proprietary knowledge of the characteristics of winning companies

In his view of the world, there are winners and losers (losers mostly). The few who understand this “proprietary knowledge” make money at the expense of those who don’t. He doesn’t buy the idea that angel investors — without the large infrastructure and different incentive structure from traditional VCs — are taking share from venture capitalists.

The Data-Doesn’t-Lie-Camp: Angels do make money

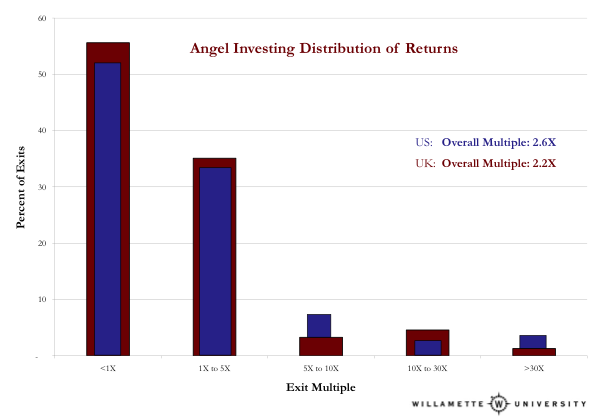

Then we’ve got Robert Wiltbank’s Angel Investors Do Make Money. Wiltbank, a professor and angel investor himself, takes a hard look at angel returns via a recent study he published at Willamette University.

Wiltbank’s research actually shows that the average multiple angel investors see is 2.5X their original investment.

So what is it? Do angel investors actually make money?

As per Wiltbank’s own admission:

[bra_blockquote align=””]In any ONE investment, an angel investor is more likely than not to lose their money, i.e. to earn less than a 1X return. It is risky. However, once investors had a portfolio of at least six investments, their median return exceeded 1X. Irving Ebert, of the Ottawa Angels, has done some outstanding Monte Carlo simulation with this data, finding that making near 50 investments approximates the overall return at the 95th percentile. Most investors will be somewhere in the middle, of course. Angel investors probably should look to make at least a dozen investments, but that’s just a rule of thumb. This is critical: Each investment has to be done as though it’s your only one; the bar can’t be lowered to enable you to more quickly build a bad portfolio.[/bra_blockquote]

Angel investing is high-risk — both authors agree on that point. But just like investing in the stock market, portfolio management becomes super important — in fact, more important than deal/security selection. Investors who diversify their risk, invest in multiple startups (50 investments approximates the overall returns at the 95th percentile), and play sound risk management can do well.

How OurCrowd helps address risk management

Of course, we all think we’re better than the average. We’re all smarter than the next guy. At OurCrowd, we’re addressing this inherent structural issue. For accredited investors on our platform, we’ve lowered minimum investments to as low as $10k in many cases. We’re enabled investors to make multiple, small bets on some of the most exciting startups.

Don’t forget — we’re putting our own money where our mouths are. We’re investing in all the deals that appear on OurCrowd. These companies have been vetted by our team according to our own proprietary investment philosophy. So, we are investing alongside our investor community, every step of the way. The idea behind OurCrowd is that investors retain control over the angel activity and build a broad and deep portfolio of companies run by some of Israel’s best entrepreneurs.

Angel investing is risky but if done correctly, can be extremely rewarding. Don’t believe us — the data says so.

![[OurCrowd in Forbes] SoftBank Invests $25 Million In OurCrowd, Israel’s Most Active VC](https://blog.gold.ocdvlp.com/wp-content/themes/Extra/images/post-format-thumb-text.svg)