OurCrowd’s Jon Medved on Bloomberg TV: Crowdfunding Building New Venture Capital Blueprint

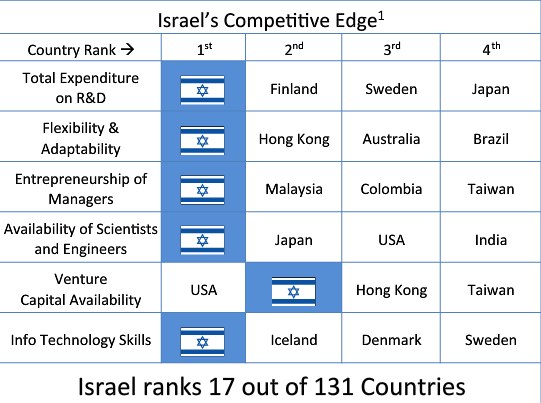

On his recent visit to the UK, OurCrowd CEO Jonathan Medved was interviewed on Bloomberg Television’s “The Pulse.” In the interview Jon discusses the startup environment in Israel using crowdfunding and OurCrowd’s efforts to expand the service to the rest of the world. Jon explains that by unlocking the power of the crowd, more people have the opportunity to invest in the best startups Israel has to offer. View the video below or play it on Bloomberg TV here....

Read More